Ever wondered how to double your money without the guesswork?

The Rule of 72 is a surprisingly simple formula that gives you the answer—fast.

No complicated math, no finance degree—just one quick calculation.

It shows how time and interest rates work together to grow your wealth efficiently.

For middle-class Indians juggling jobs and bills, learning how to double your money smartly can be a game-changer.

“It’s not about how much you earn. It’s about how well you grow it.” — The LifeTrackR

Change How You See Time and Money

We’re used to thinking of investments in terms of how much we make. But what if we started thinking about how fast our money doubles?

The Rule of 72 shifts your mindset from vague long-term goals to clear, time-bound milestones.

Instead of “I hope my investment grows,” you’ll say:

“I know this will double in 9 years.”

That clarity changes how you plan, invest, and even spend.

What Is the Rule of 72?

It’s a simple formula to estimate how many years it takes to double your investment at a fixed annual rate of return.

The Formula:

Years to Double= 72 ÷ Interest Rate (%)

So for example if your investment earns 8% annually:

72÷8 =9 Years

Or if you want to double your money in 6 years, the return required is:

72÷6 =12%

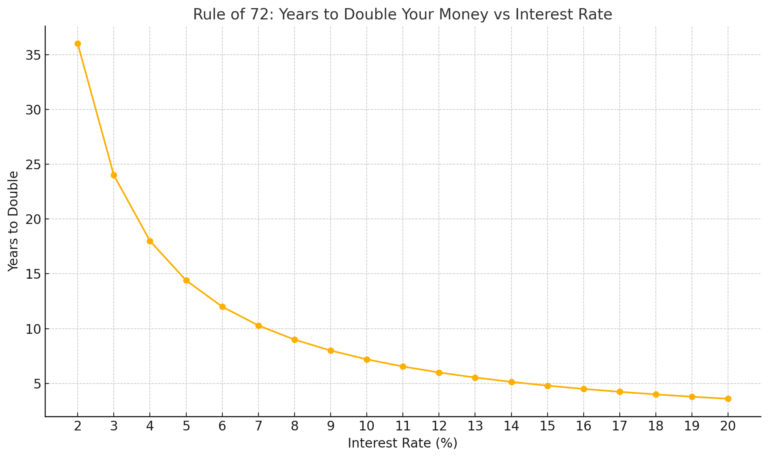

Need a quick reference for different rates?

This chart shows how the Rule of 72 plays out across interest rates from 2% to 20%:

Where You Can Use the Rule of 72

This rule works best with compounded annual interest rates and for moderate returns (6%–12%).

Apply it to:

- Mutual funds

- Fixed deposits

- Bonds

- Index funds

- Real estate (with steady appreciation)

- Inflation analysis (Yes, it can show how fast your purchasing power halves!)

Practical Examples

1. Mutual Fund with 9% Return

72÷9=8 years to double72 ÷ 9 = 8 \text{ years to double}72÷9=8 years to double

2. Bank FD with 6% Return

72÷6=12 years to double72 ÷ 6 = 12 \text{ years to double}72÷6=12 years to double

3. Inflation at 6%

Your money will lose half its value in 12 years.

Step-by-Step Guide to Using It in Real Life

Step- 1. Know Your Investment’s Interest Rate

Check your fund’s average annual return, or estimate conservatively.

Step- 2. Apply the Formula

Use 72 ÷ Interest Rate to get the doubling time.

Step- 3. Compare Investments

Want faster growth? Compare how long it takes to double across FDs, SIPs, or gold.

Step- 4. Assess the Power of Inflation

Inflation isn’t just a number. Use the Rule of 72 to see when your money will lose half its value.

Double Smarter, Not Just Harder

Once you understand the Rule of 72, you no longer wonder “Is 10% a good return?” You’ll see the time value of that return.

It empowers you to choose smarter investments, reject poor ones, and have a clear idea of where you’re headed financially.

Conclusion

The Rule of 72 is proof that you don’t need a finance degree to make smart money decisions. With just one number, you can predict your future wealth, compare investments, and stay one step ahead of inflation.

Use it wisely. Apply it often. And let it guide your path to financial freedom.

FAQs

- What is the Rule of 72?

A formula to estimate how long it takes to double your money at a fixed annual interest rate. - How do I use it?

Divide 72 by the annual rate of return. That gives you the doubling time in years. - Can it be used for monthly compounding?

It’s a rough estimate. For more accuracy with monthly compounding, use 69.3 instead of 72. - Is the Rule of 72 always accurate?

It’s most accurate between 6–12% interest rates, with annual compounding. - Can I use it to compare investments?

Absolutely. It helps you quickly compare how long different investments take to double. - What if I want to know the return required to double in a certain number of years?

Reverse the formula: 72 ÷ years = required return. - Can I apply this to inflation?

Yes. Use inflation rate to see when your money’s value halves. - Is this applicable to all types of returns?

Only when the return is compounded. It doesn’t work well with simple interest or non-compounding scenarios.

Want to learn more simple tools to grow your wealth? Explore more on The LifeTrackR finance guides.

#RuleOf72 #SmartInvesting #DoubleYourMoney #FinancialLiteracy #WealthBuilding #MoneyTips #LifeTrackR #CompoundInterest #InvestSmart #PassiveIncome #FinancialGoals #MoneyMindset #FinanceHacks #GrowYourMoney

Editor’s Note: This article was originally published here https://thelifetrackr.com/how-the-rule-of-72-can-double-your-moneywithout-doubling-your-effort/ by @Kairav and @krutika