If you’ve ever sat with a cup of chai, looked at your bank statement, and wondered, “How long will it take for my money to double?”, you’re not alone.

Many middle-class Indians want their savings to grow faster—whether it’s for buying a house, children’s education, or a comfortable retirement. But here’s the surprising part: you don’t need complicated math or expensive software to get an estimate.

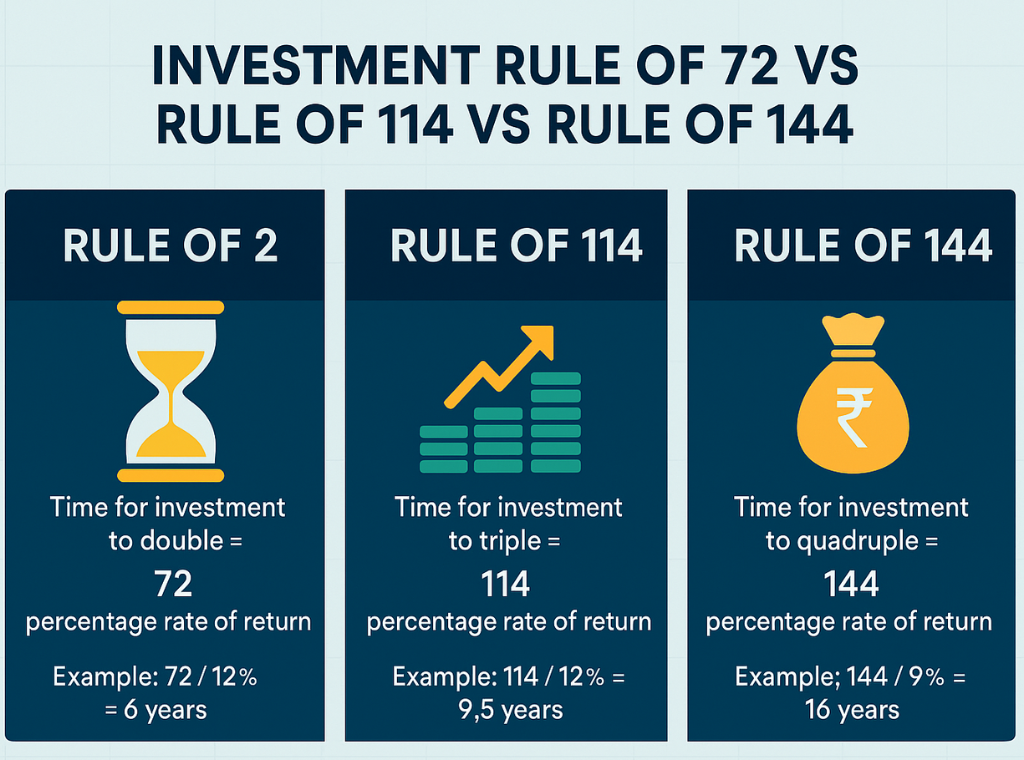

All you need is something called the Focus keyphrase – the Investment Rule of 72. And along with it, there are two more lesser-known cousins—the Rule of 114 and the Rule of 144—that can help you estimate when your money will triple or quadruple.

Let’s break these down in the simplest way possible.

The Investment Rule of 72 – Your Money’s Doubling Formula

The Investment Rule of 72 is the most basic and widely used method in personal finance. Fund managers, financial advisors, and even mutual fund companies quietly use it every day.

It’s a quick way to calculate:

- How long your money will take to double at a given rate of return

- What rate of return you need to double your money in a specific time

Formula:

- Time to double = 72 ÷ Rate of Return (%)

- Rate of return = 72 ÷ Number of Years

Example 1 – Time to double

You invest ₹2,00,000 in a scheme that gives 12% annual return.

Time to double = 72 ÷ 12 = 6 years.

So, in 6 years, your ₹2,00,000 becomes ₹4,00,000.

Example 2 – Rate of return

You want your ₹2,00,000 to double in 6 years.

Required return = 72 ÷ 6 = 12%.

You can use this for FDs, mutual funds, real estate, gold, or even to see how inflation eats away your money.

Inflation Example:

If inflation is at 8%, your money will lose half its value in 72 ÷ 8 = 9 years.

The Rule of 114 – Tripling Your Money

Once you know how to double your money, the next question is—how long will it take to triple?

That’s where the Rule of 114 comes in.

Formula:

- Time to triple = 114 ÷ Rate of Return (%)

- Rate of return = 114 ÷ Number of Years

Example:

You invest ₹2,00,000 at 12% annual return.

Time to triple = 114 ÷ 12 = 9.5 years.

Your ₹2,00,000 becomes ₹6,00,000 in about 9.5 years.

While useful, the Rule of 114 isn’t as precise as the Rule of 72, especially if your returns are irregular.

The Rule of 144 – Quadrupling Your Money

For long-term investors who are patient enough to see their investment grow four times, there’s the Rule of 144.

Formula:

- Time to quadruple = 144 ÷ Rate of Return (%)

Example:

₹2,00,000 invested at 9% annual return takes:

144 ÷ 9 = 16 years to grow into ₹8,00,000.

This rule is more for long-term planning—think retirement savings or property investments.

When These Rules Work Best

These rules are most accurate when:

- The rate of return is between 5% and 12%

- Returns are compounded annually

- You want a quick estimate rather than an exact figure

Adjusting for Higher Returns

If your rate of return is outside the 5–12% range, small adjustments improve accuracy:

- Add 1 to 72 for every 3% increase above 8% return

Example: For 15% return → Use 73 instead of 72

Real-Life Application for Indian Investors

1. Comparing FD vs Mutual Fund:

If an FD offers 7% and a mutual fund offers 12%,

- FD doubles in ~10 years (72 ÷ 7)

- Mutual fund doubles in 6 years (72 ÷ 12)

2. Planning Child’s Education:

If you need ₹10 lakh in 12 years, the Rule of 72 tells you the return you’ll need to double your current ₹5 lakh → 72 ÷ 12 = 6% return.

3. Inflation Check:

With 8% inflation, prices double in 9 years—so your savings need to beat this rate to maintain purchasing power.

Limitations You Should Know

- Works best with returns between 5%–12%

- Not as accurate for very high or very low rates

- Doesn’t account for taxes, fees, or market fluctuations

- Assumes annual compounding, not quarterly or monthly

These rules should be your quick mental calculator, not a replacement for detailed financial planning.

FAQs – Investment Rule of 72, 114, and 144

1. What is the main use of the Rule of 72?

It quickly estimates how long your investment will take to double at a fixed rate of return.

2. Can I use these rules for SIP investments?

Yes, but they work best with lump-sum investments. SIPs require slightly different calculations.

3. Are these rules accurate for all returns?

No. They are most accurate for 5%–12% returns.

4. Can I use these rules for inflation?

Yes, they can estimate how fast your money loses value due to inflation.

5. Which rule should I focus on most?

The Rule of 72—it’s the most reliable and widely used.

6. Do these rules apply to gold or real estate?

Yes, as long as you know the average annual return.

7. How do I adjust for higher returns?

Add 1 to 72 for every 3% increase above 8% return.

8. Can taxes affect these calculations?

Yes, after-tax returns will change your doubling/tripling time.

Final Thoughts

The Investment Rule of 72 is your best friend for quick money-doubling calculations. The Rule of 114 and Rule of 144 are great for understanding longer-term growth, but they’re more for knowledge than precision.

Remember—these are guidelines, not guarantees. Use them for quick comparisons, but always back them up with proper research, risk assessment, and a solid financial plan.

At The Life TrackR, we believe smart investing starts with awareness. Once you know how your money grows, you can take confident steps toward your financial goals.

#InvestmentTips, #RuleOf72, #RuleOf114, #RuleOf144, #PersonalFinanceIndia, #TheLifeTrackR, #MoneyGrowth, #IndianInvestors, #SmartInvesting, #FinancialFreedom, #WealthBuilding, #MoneyMatters, #InvestSmart

Editor’s Note: This article was originally published here https://thelifetrackr.com/investment-rule-of-72-vs-rule-of-114-vs-rule-of-144-explained-for-every-indian-investor/ by @Kairav and @krutika